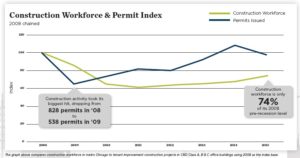

The financial recession of 2008 – 2009 resulted in a 39% decrease in the city’s construction workforce between 2008 and 2011. Simultaneously, the office commercial real estate industry felt a slowdown in leasing activity and […]

Posts By: Scott Shelbourne

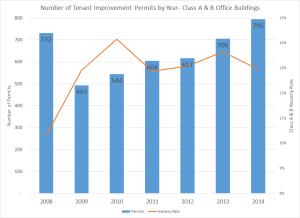

Since January 1, 2008 until April 30, 2015 the City of Chicago issued 4,723 renovation / alteration building permits for downtown Class A & B office buildings. These permits total $2.56 billion dollars spent on […]

A common discussion around noon in many offices revolves around where to eat lunch. After multiple years of working in the same office building, lunch starts to feel like Groundhog’s Day as people tend to […]

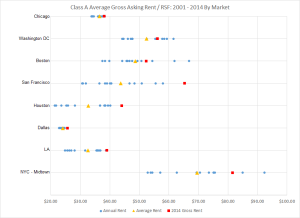

When a tenant decides to renew, renegotiate or relocate their office space they have to deal with multiple financial risk factors. Typically, a tenant signs a long term lease in which the economic terms are […]