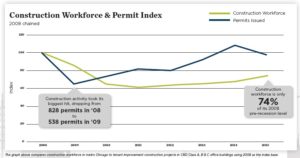

The financial recession of 2008 – 2009 resulted in a 39% decrease in the city’s construction workforce between 2008 and 2011. Simultaneously, the office commercial real estate industry felt a slowdown in leasing activity and […]

Latest Posts Under: Construction

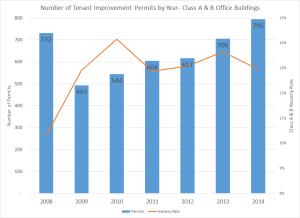

Since January 1, 2008 until April 30, 2015 the City of Chicago issued 4,723 renovation / alteration building permits for downtown Class A & B office buildings. These permits total $2.56 billion dollars spent on […]